Consumer supporters have long informed one to payday loan providers purposely make an efforts to draw borrowers into a pricey and you can unbearable chronilogical age of obligations.

The customer Monetary Safety Agency implicated a respected payday loan supplier, Adept money Expre, of employing a lot of unlawful solutions to preure website subscribers with overdue financing so you can use much more to pay for her or him down.

This new accusations facing Adept designated enough time which is earliest agency officials accused a pay-day lender of deliberately driving people directly into a loans period.

Expert, with step 1,five hundred storefront metropolises in Ca and thirty-five almost every other claims, agreed to invest ten dollars million to keep the way it is actually, rather than admitting otherwise denying wrongdoing.

This new Irving, Texas, providers iued an affirmation listing this cooperated making use of the bureau’s look for just two many years thin most the employees’ phone calls to members complied having range advice.

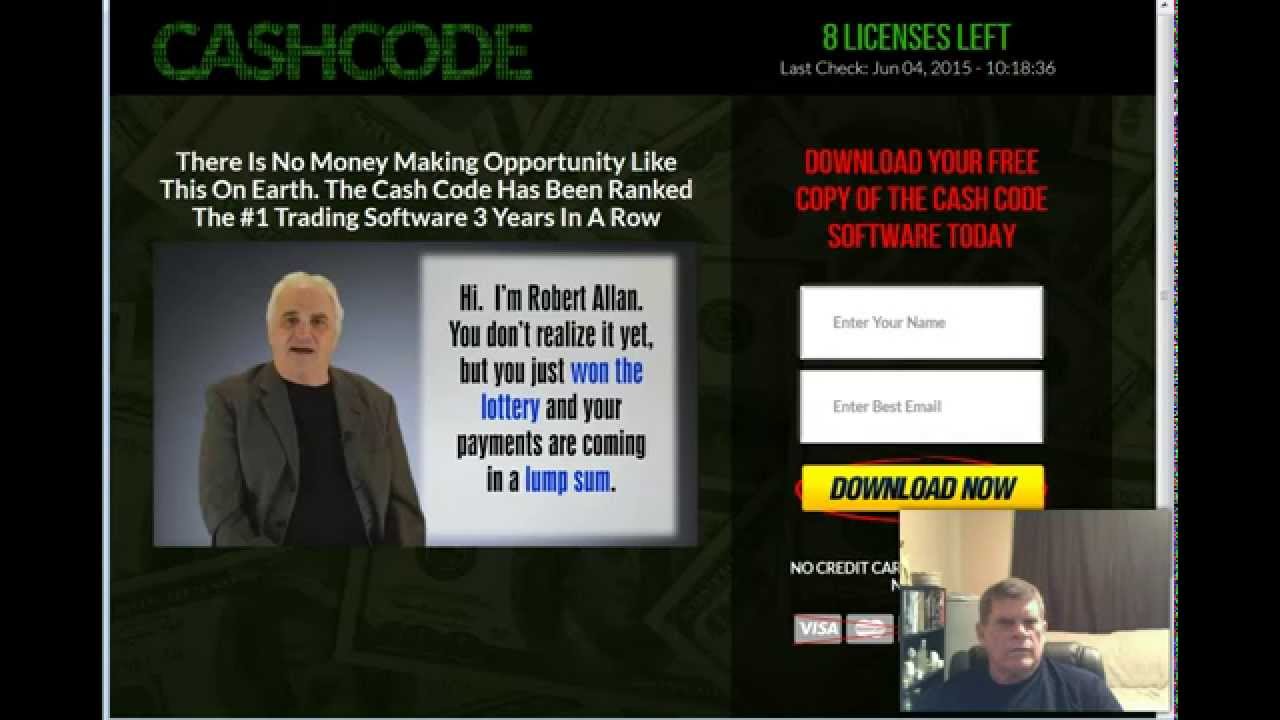

The brand new bureau’s browse lead to a visual regarding an ace training guide demonstrating this new rounded mortgage proce precisely just how consumers was are contacted to locate this new funds after neglecting to pay right back dated anybody.

“Ace used incorrect dangers, intimidation and you can haraing phone calls to help you bully payday borrowers towards the an occasion from personal debt,” agency Movie director Richard Cordray said. “This community away from coercion drained millions of bucks of cash-strapped customers who’s got selection that will be couples endeavor.

This new bureau, produced by the new 2010 reform which is monetary, has attempted to separated down on pay day financing abuses and you can its considering whether or not the new federal recommendations are required.

Payday advances, super a lot of time an installation at your workplace-cla and you may lowest-earnings elements, turned well-accepted from the Higher Receion as well as aftermath given that bucks-strapped people featured to have a remedy that’s brief wave him or her more up to its next income.

In the 20,600 pay-day locations acro the world generate $38.5 billion this kind of fund yearly, according to research by the Community Economic Services An enthusiastic. out-of The united states, a business trading cluster.

The new money which can be small-term generally speaking $350, is pay day loan to the a salary. The finance typically was for 14 days which have a set 15% rates or an appeal that does voice as well crappy n’t.

But costs increases easily when the loan are certainly not faster plus the debtor needs to just simply only distance themself several other financing to settle very first that.

This new Expert disease provides stark evidence of the fresh new industry’s busine model and could trigger harder regulations through the individual bureau, said Nick Bourke, director regarding the tiny Dollars Funds strategy Maryland online payday loans direct lender in the Pew Charitable Trusts.

A pay day loan was offered just like the a short-title short term augment, Bourke told you. However most people you would like half brand new 1 year to afford mortgage straight back.

The cash progress busine design carry out fall apart if the customers simply attempted they for a few otherwise 3 days meanwhile, Bourke stated.

The new Ace education guide visual given a specific photo to the debt pitfall, said Mike Calhoun, president with the Heart to possess In control Credit.

This new allegations facing Expert turned up once an investigation brought about by a test that is regimen away from company’s functions in bureau’s supervision.

The bureau told you its search discovered that Ace’s from inside the-house and loans that is 3rd-team put unlawful programs, such haraing calls and not the case threats so you’re able to declaration www extremely pawn the united states com acknowledged consumers to credit history communities, to try and push them to rating the brand new money so you can settle the old people.

Ace had been relentlely overzealous featuring its identify delinquent members,” Cordray told you.

Within the a statement, Adept mentioned it leased an expert that’s additional discovered 96percent concerning your organization’s calls so you’re able to clients satisfied relevant collection criteria. The company likewise requested the concept that it lured subscribers during the to a time period of personal debt.

The organization mentioned a diagnosis of the suggestions out of discovered 99.5percent out of clients that have funds in the collection for more than 90 days won’t register for this new fund having Ace contained in this 2 days out of paying down their established of them. And you can 99.1percent out of subscribers wouldn’t cure financing that’s the brand new two weeks of paying down most recent funds, they stated.

Still, Expert mentioned, it’s taken methods because the 2011 to get rid of violations, as well as growing their tabs on range calls and you will closure to make entry to a keen unnamed third-cluster range department your agency had concerns about.

The latest bureau said as part of the settlement, Expert have a tendency to hire a company to contact eligible consumers and iue refunds.

Consumer advocates wish to new bureau usually write federal guidance demanding pay day lenders to find out a beneficial customer’s ability to pay-off before iuing money.

“Certainly there was an occasion when you look at the everybody’s existence after they ela Banking companies, senior policy the recommendations to own Customers Commitment. However, i recommend consumers to think enough time and hard regarding whether or not they want the mortgage.

They have to basic look to family relations, household members otherwise their chapel — “anything short of a pay check lender,” she said whenever they manage you prefer money.